Market Recap: Sharp Sell-Off as Tariff Shocks Hit Nifty & Bank Nifty

Indian equity markets served a reality check before the festival break. Nifty 50 opened near 24,899 and climbed briefly to 24,919 before sellers took charge and pushed it to 24,712, down ~1 %. Bank Nifty opened around 54,999 and closed at 54,450 (‑1.2 %), also ending near its session low. Heavyweights such as Reliance, Axis Bank and ICICI Bank dragged the indices, while Hindustan Unilever and ITC provided the only respite as the FMCG sector rose ~0.9 %. The sell‑off coincided with news that the U.S. may levy a 50 % tariff on Indian goods[4] and a weak handover from European and U.S. markets. Foreign investors sold roughly ₹6 ,516 crore and domestic funds bought about ₹7 ,060 crore. Indian markets were closed on 27 Aug for Ganesh Chaturthi and resume trading on 28 Aug.

Technical Landscape and Option Chain

Nifty 50 – The index sits below its short‑term moving averages after forming a long bearish candle. A key support zone lies near 24,650, followed by 24,500; resistance is around 24,760 (the prior session’s pivot) and 24,900. Daily RSI has slipped below 50 and the MACD histogram is negative, hinting at weakening momentum. Bank Nifty shows a similar picture with support at 54,100 and resistance near 54,650; its RSI hovers just above 50 while MACD signals a fresh bearish crossover. Rising volumes on down days suggest distribution pressure.

Option‑chain clues – For the 28 Aug weekly expiry, call writers dominate. In Nifty, the largest call open‑interest (OI) stands at 25,000, 25 200 and 24,800 strikes, while put writers are concentrated around 24,000, 24,500 and 24,600. The put–call ratio (PCR) is around 0.57, reflecting more calls than puts. For Bank Nifty, call OI is heaviest at 57,000, 56,000 and 55,500, whereas the biggest put OI sits near 54,000 and 53,000. The PCR is roughly 0.42. Such positioning implies traders expect limited upside and are defending higher levels; support could emerge near 24,000/54,000, but the heavy call build‑up above may cap rallies.

Sentiment Snapshot

- Retail traders: After the sharp fall, many retailers may feel nervous. Expect bottom‑fishing attempts near support zones but also quick profit‑taking on rallies. Risk appetite may be limited due to the holiday gap.

- Institutional investors: FIIs are likely maintaining hedged positions and may resume selling if global markets weaken. DIIs could offer support near key levels, but they may also lighten positions ahead of domestic macro data.

- Market makers & speculators: With options expiry around the corner, expect lower liquidity and wider spreads. Option sellers may favour short straddles around 24 ,700 (Nifty) and 54 ,500 (Bank Nifty) to capture time decay.

- FII/DII outlook: The long/short ratio for FIIs in index derivatives is close to 1, suggesting balanced positions. DIIs may continue buying selectively, particularly in defensives.

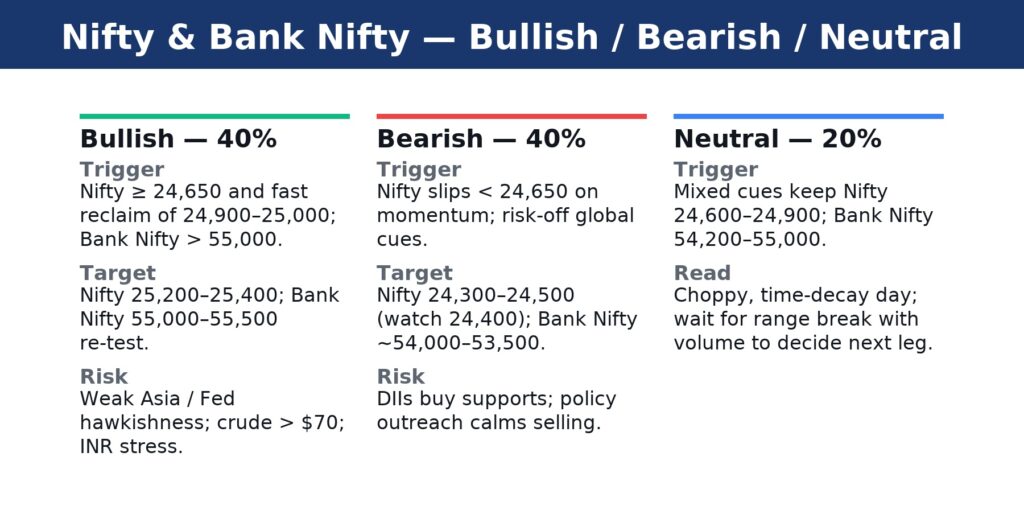

Bullish, Bearish or Neutral — Which Path Will Nifty Take?

- Bullish Case (40% chance): If Nifty holds 24,650 and quickly reclaims 24,900–25,000, short-covering could fuel a bounce to ~25,200–25,400 (near spider-software targets at spidersoftwareindia.com). Strong catalysts: Fed softness, any rollback of tariff rhetoric, or a rebound in global tech/energy. Under this case, Bank Nifty could retest 55,000/55,500. Heavyweights to watch: Reliance Industries above ₹1,400 could ignite energy stocks; HDFC Bank above ₹1,000 (post-split basis) could revive financials; IT names breaking near-term resistance (Infosys ~1540, TCS ~3180) could lead a secondary rally. (Why: Bull case looks tempting on oversold charts, but weak Asian cues or renewed Fed hawkishness could halt any follow-through. If markets rally without global confirmation, it may quickly fizzle.)

- Bearish Case (40%): If the tariff news intensifies or global equities falter (say, Nvidia disappoints or U.S. yields spike), expect Nifty to revisit 24,600 and even 24,400. A clear break below 24,650 likely drags it toward 24,300–24,500. Then 23,900/24,000 PEs may provide extreme support. Key risk stocks: L&T, Tech Mahindra (rupee‐sensitive) could break key supports; Axis Bank, Kotak below ₹1,040–1,050 could weigh on BankNifty. Crude above $70 or RBI inaction could exacerbate the fall. (Why: Bear scenario may overshoot: DIIs might step in near 24,500 and markets could bounce from oversold readings. Plus, any sign of the government engaging with the U.S. could arrest the slide.)

- Neutral Case (20%): If global cues and domestic factors are mixed, we could see Nifty trade sideways in 24,600–24,900, building a base. Market chops around key levels (SPX tug-of-war, INR range-bound) would keep a lid on momentum. In this case, Bull and Bear catalysts cancel out. Watch intraday range: a sustained move out of ~24,600–24,900 will decide the next leg. (Why: Range-bound action risks whipsaw for traders; a strong trigger (good news or bad) is needed for conviction.)

Ultimately, the probability weighs roughly equal for up/down (~40% each) with a slight nod to range-trade (20%) given the mixed signals. In our view, the market is straddling a key inflection: if global relief and DIIs continue, the bulls regain; if trade war escalates, the bears will prevail. We lean cautiously bullish into any successful bounce, but remain ready to flip if the range breaks.

Key Stock Watchlist: Smart Picks and Hidden Strength for 28 Aug

| Stock (Heavyweight) | Key Levels | Why Watch |

| Reliance Industries | Support ~₹1 ,374; Resistance ~₹1 ,403 | A barometer for Nifty; under pressure from tariff risk—holds the key to any recovery. |

| ICICI Bank | Support ~₹1 ,410; Resistance ~₹1 ,425 | Weakness in financials weighed on Bank Nifty. A breach below support could drag the index further. |

| Hindustan Unilever (HUL) | Support ~₹2 ,643; Resistance ~₹2 ,724 | FMCG leader showing relative strength; may continue to outperform in risk‑off mood. |

| Infosys | Support ~₹1 ,519; Resistance ~₹1 ,539 | IT sector remains resilient; watch for follow‑through buying. |

| HDFC Bank | Support ~₹960; Resistance ~₹990 | Price drop reflects stock split; how the market digests the new price will influence sentiment in banking heavyweights. |

Levels are based on pivot analysis of 26 Aug data; adjust for any overnight moves. Always use appropriate stop‑loss orders and position sizing.

No Confusion, Only Clarity: What Traders Should Do Tomorrow

- Pre‑open checklist: Check Gift Nifty, global indices and USD/INR before the bell. Review your watchlist and set alerts near the support/resistance zones mentioned above. Limit overnight positions given the holiday gap and upcoming macro releases.

- Intraday triggers: If Nifty stays above 24,650, short‑term traders can look for bounces toward 24,760 and beyond with tight stops. A fall below 24,650 could open the door to further weakness toward 24,500. Use similar levels of 54,100 and 54,650 on Bank Nifty.

- Risk management: Avoid chasing gap‑ups or panic selling. Scale into positions and use trailing stops. Trade only with risk capital—protect your principal at all times.

- Stay calm: The market will provide new opportunities regardless of direction. Focus on discipline and patience rather than predicting every tick. With proper preparation, retail traders can navigate the volatility without losing sleep.