Think of financial markets like a big web—a tug on one end shakes everything else. If Wall Street sneezes in New York, traders in Mumbai might feel the shiver. That’s why Indian investors watch not just the Nifty or Sensex, but also oil prices, the rupee, global indices, and even gold.

Hidden Correlations: Who Really Moves With Whom?

Imagine two friends walking side by side. If they always move together, that’s a correlation near +1. If one goes left when the other goes right, that’s closer to –1.

- Assume the Nifty, Sensex and the Dow Jones are like friends who walk together about half the time (0.5–0.6 correlation).

- When U.S. markets jump, the Nifty 50 and Bank Nifty often follow.

- Since India buys most of its oil, rising crude prices can eat into profits.

- A weak rupee is bad for importers (like airlines) but great for exporters (like IT and pharma).

- Higher bond yields mean they make loans expensive and make stocks look less attractive compared to “risk-free” bonds.

For more daily insights, check our Daily Market View updates.

Smart Sector Rotation: Tracking the Hidden Flow of Money

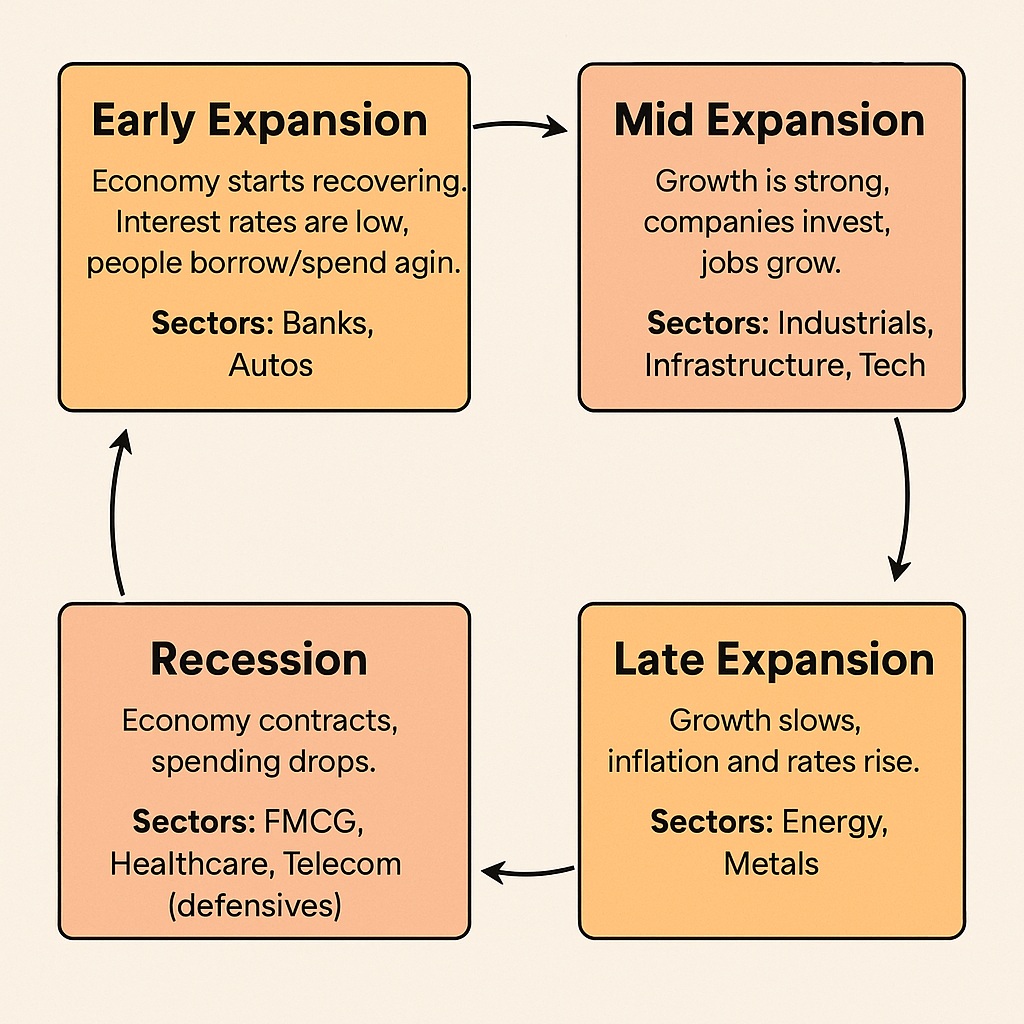

Imagine investors as travelers moving from one city (sector) to another depending on the weather (economy).

- During early expansion: Low interest rates and fresh demand push money into autos and banks.

- Then, in mid expansion: Strong growth lights up industrials, infrastructure, and tech.

- Later, during late expansion: Rising inflation and rates fuel energy and metals.

- Finally, in Recession: People retreat to “safe towns” like FMCG, healthcare, and telecom.

And sometimes news acts like a sudden storm:

- A rate cut can spark rallies in banks and autos.

- Cheaper oil helps airlines and paint companies be happy.

- Rising rates will squeeze banks’ profits.

Powerful Cross-Market Signals: Connecting Every Move

Markets don’t live in isolation — they talk to each other.

- Stocks versus Bonds versus Commodities: In good times, stocks and commodities rise together. As a result, when growth slows, bonds shine. High bond yields compete with stocks by offering safer returns.

- Currency: A weak rupee is a gift to exporters but pain for import-heavy sectors like aviation and FMCG.

- Gold: For example, gold acts as a ‘safety umbrella.’ Investors run to it when the storm hits because it doesn’t always move like stocks or bonds.

- Foreign flows: When FIIs (big foreign investors) pour money in, markets rally. When they leave, markets wobble. DIIs (domestic investors) often step in to balance things out.

See more sector insights in our Stocks in Focus section.

Proven Scenario Planning: Smart ‘What If’ Market Stories

Instead of guessing one outcome, think in stories:

- Bullish (40% chance): If global markets are upbeat, crude is stable, the rupee is steady, and FIIs are buying. Autos, banks, IT, and infra will lead the market.

- Bearish (40% chance): If bond yields jump, crude and metals surge, the rupee falls, and FIIs sell. Import-heavy sectors bleed; gold shines.

- Neutral (20% chance): Signals are mixed, and markets move sideways, waiting for clarity.

These aren’t predictions, just ways to frame your thinking — so you’re ready for different outcomes.

Your Smart Daily Market Checklist: Proven Steps Before Trading

Think of this as your quick morning routine before trading:

- Global cues: What did the Dow, S&P 500, and Nasdaq do overnight?

- Crude & rupee: Rising oil + weak rupee = pressure on FMCG, aviation, and energy. Falling oil and a stable rupee are a relief.

- Bond yields: Higher yields = tighter conditions, often bad for stocks.

- Sector leadership: Which sectors fit today’s economic mood?

- FII/DII flows: Who’s buying, and who’s selling? This often sets the tone.

The Big Picture: How to Truly Connect Hidden Market Dots

Markets might look noisy, but every move is part of a bigger story. If you learn to connect these signals—global indices, crude, rupee, bonds, gold, and investor flows—you’ll read the market with much more clarity.

You can refer more data from Moneycontrol (https://www.moneycontrol.com), Reuters (https://www.reuters.com), and NSE India. https://www.nseindia.com, NSE Archives https://nsearchives.nseindia.com, Bloomberg https://www.bloomberg.com/markets, Economic Times Markets https://economictimes.indiatimes.com/markets.

The market always carries a hidden flow of signals, and learning to truly connect them can change the way you trade. What you read today is only the beginning—in the coming updates, we’ll share even more powerful insights, smart strategies, and proven ideas that you won’t want to miss.

Stay tuned—the next post could reveal a connection that completely shifts how you see the markets.