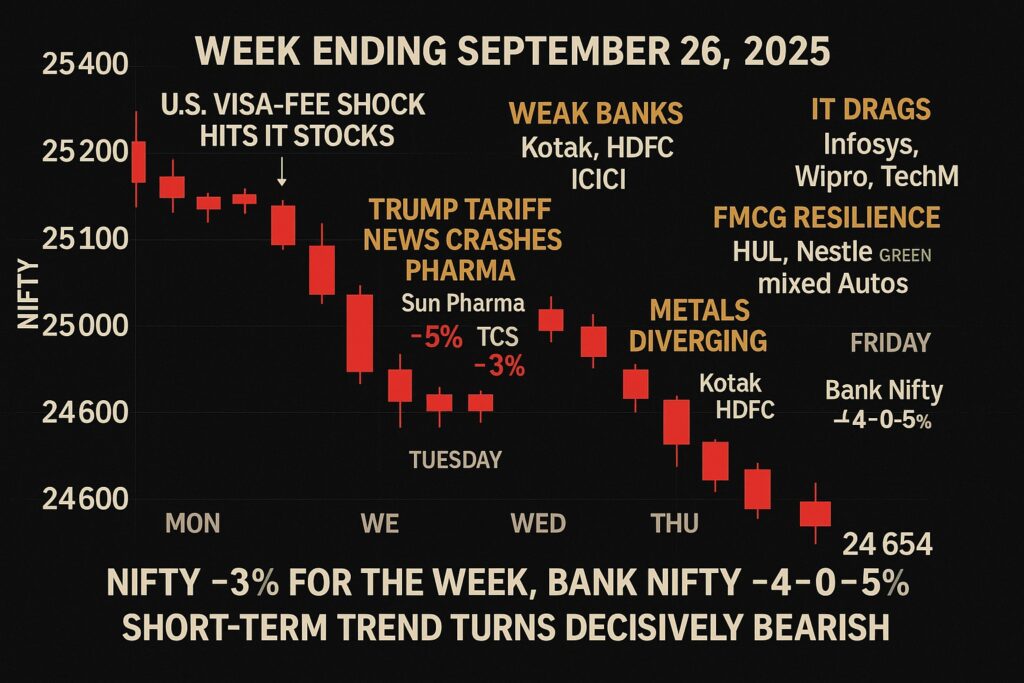

The week unfolded as a broad selloff. After a gap-down open on Monday, Nifty and Bank Nifty sank steadily into Friday, erasing gains from earlier in September. Monday’s session saw a sharp drop (Nifty lost ~125 pts to 25,202) as tech stocks fell on U.S. visa-fee shocks[1]. Tuesday saw a mild pullback (Nifty ~25,169) with auto and banks trying to hold ground against continued IT weakness[2]. By midweek Nifty was under 25,100 (Wednesday close ~25,057) as profit-booking widened beyond IT into autos and metals[3][4]. Thursday extended the slide (Nifty ~24,890) as broad selling dragged down banks, financials and cyclicals[5]. On Friday Nifty finally broke below 24,700 (24,654) amid steep losses in pharma and IT (Sun Pharma ‑5%, TCS down ~3%) after Trump’s announcement of tariffs on drugs[6]. Over the week Nifty fell ~3%, hitting fresh 3‑week lows, while Bank Nifty slid 4–5% into the mid-54,000s. The trend was firmly down: daily closes stamped a bearish ladder each day (25,202 → 25,169 → 25,056 → 24,890 → 24,655).

Key heavyweight moves: Banking stocks underperformed early (Kotak Bank fell below its 50‑DMA) and HDFC Bank/ICICI were weak midweek[7]. IT bellwethers (TCS, Infosys, Wipro, TechM) were big drags on multiple days[8][9]. Reliance Industries was relatively stable, but energy names slipped late. Auto was mixed (Tata Motors, Hero down, Bajaj Finance resilient on seasonal demand). FMCG (HUL, Nestle) outperformed – only FMCG stayed green on Wednesday[10]. Metals saw divergence: Hindalco/NTPC held up, while BHARAT Electronics and other tech‑defense names were weak. Overall breadth was poor: midcaps and smallcaps were down ~1% each. In short‐term, the weekly and monthly trends turned decisively bearish (Nifty broke below its Sep uptrend and 20‑day MA).

What to expect for Next WeeK

- Nifty Support/Resistance: Key support lies in the 24,500–24,700 zone (last trough around 24,650 and fib/MAs)[11]. Below that, 24,400–24,300 could come into play (previous swing lows). On the upside, immediate resistance is around 24,800–25,000 (last week’s intraday highs). A daily close above 25,000–25,100 would be needed to ease the downtrend[11].

- Bank Nifty S/R: Next support ~54,000–54,200 (downside gap). A breach here risks 53,500. Resistance comes in 55,000–55,500 (last week’s bounce highs) and stronger at ~56,000. Recent close below 54,400 warns of further weakness[12].

- Patterns: Both indices show bear candles with upper wicks (rejection of higher levels). Nifty has formed a short-term down‑trend channel. No bullish reversal pattern yet. RSI (daily) is in neutral-to-oversold zone; weekly RSI is nearing 40. MACD histogram is negative and widening – momentum favors the bears. Volumes on declines have been higher than rallies, signaling conviction in selling. The India VIX has spiked, reflecting volatility.

- Momentum indicators: Daily MACD is below its signal line; RSI ~35 (bearish). Bollinger bands are expanding, price hugging the lower band – often a sign of strong downtrend. Yet, stochastic is near oversold, so a short bounce is possible.

Fundamental & News Drivers

- Domestic News: The big domestic theme was the GST rate cut and Navratri sales, giving automakers a relief rally on Tuesday[13], but broad sentiment turned negative on the fall of IT and pharma. CPI inflation unexpectedly held around 5% this week, and RBI’s minutes (Sept 6) reiterated sticky inflation – supporting a neutral-hawkish RBI stance. (Markets are pricing RBI to hold rates in Oct)[14]. The rupee weakened to ~₹88.75 on Friday as hawkish Fed expectations persisted and FIIs sold (versus ₹88.20 support noted by analysts)[15].

- Global Markets: U.S. stocks were mixed – the S&P 500 traded near flat on Friday as Fed speakers (Chicago Fed’s Goolsbee) hinted rates can eventually come down if inflation cools[16]. NASDAQ and Dow futures were unchanged. However, a late-week shock erupted: President Trump announced a 100% tariff on imported branded drugs (and 25% on heavy trucks)[17]. This news crushed global pharma stocks and sent U.S. bond yields down (safe-haven flows). Oil prices eased slightly from a 7-week high (Brent ~$68) on profit-taking and supply news, but still near mid-$60s[18]. The US 10-year Treasury yield slid after weaker jobs data (US Sep payrolls came in soft at +160K), reinforcing the “Fed pivot soon” narrative.

- Sector Drivers: The Pharma sector in India felt the hit as investors worry about export tariffs – Sun Pharma hit a 52-week low Friday[19]. IT sentiment remained grim (H-1B fee hike fears), as seen in weekly FII outflows. Autos: Dealer enquiries picked up on GST cuts in Navratri, but stocks still gave up early gains by Fri. Metals: Nomura’s bullish steel call supported Tata Steel/JSW Steel, with copper news boosting Hindustan Copper slightly. Banks: Q2 quarter estimates did not see a major provision shock, so big banks only modestly underperformed.

- Global Cues: Asian markets closed lower (Nikkei down ~0.5%, Shanghai -1%). Europe ended mixed. Crude volatility (Brent $68) kept Oil & Gas stocks shuffling. Gold rallied as haven flows returned (hovering ~$1960/oz). The Fed’s next meeting (mid-Dec) is far off, but every Fed comment is watched. FII selling resumed heavily all week (net ~₹17-18k Cr sold)[20], while DIIs bought the dip (net +₹14k Cr week, shoring up blue-chips).

- Geopolitics: The new U.S. tariffs sparked concerns of a fresh trade war and hit sentiment globally. No major India-specific geopolitical event this week, though local monsoon rains are winding down (no big impact on agri).

Market Mentality & Participant Behavior

- Retail: On the street, fear is rising. Traders fear missing the rally turned into fear of deeper falls as volatility climbed. Many retail longs were shaken out midweek; short-covering on rallies was weak. RSI oversold levels have prompted some speculative dip-buying (especially in FMCG, staples), but overall caution reigns. Social chatter shifted to profit-protection mode.

- Institutions (DIIs/HNI): DIIs have been buying quality names on dips all week (as data shows[20]). Large mutual funds were accumulating defensives (FMCG, pharma at oversold) and selective bankers (HDFC Bank, ICICI on dips). However, foreign FIIs remained net sellers each day, indicating cautious view; they especially lightened tech and financials. Some HNI desks likely ramped short positions given the strong downtrend.

- Market Makers: Liquidity in index futures remained high with wide bid-ask spreads on Friday’s swoon. The volatility term structure (VIX) is inverted (near-term > longer term), suggesting a fear premium. Market-makers are probably hedged aggressively (selling futures into rallies, buying protection).

- Speculators & Prop Desks: Short-term prop desks have been riding the short momentum on Nifty futures. Open interest in BankNifty calls spiked early (55000 calls), but heavy put buying around 54000 suggests traders positioning for a continued fall[21]. On expiry (Thursday), rollovers and shift in strike interest indicated bearish bias. Some contrarian tech option buyers emerged (OTM IT calls) hoping for a relief rally, but this is low conviction.

- FII/DII Flows: Foreign institutional outflows dominated: ~–₹5,000-6,000 Cr each on Thu/Fri[20]. Over 5 trading days they dumped ~₹20,000 Cr. Domestic institutions (mutual funds, insurance) absorbed much of this, net buying ~₹14k Cr. The flow trend suggests FIIs took profits after a big buy-run in Aug, and DIIs are using the weakness to add good stocks. This FII selling set a negative tone going into next week.

- Conclusion on Sentiment: Bearish tilt dominates. Only a clear change in global sentiment or a catalyst (like an outsized FII buy) could flip the mood. For now, participants are braced for more downside or choppy consolidation, and liquidity preferences (higher yields, safe assets) are up.

Scenario Planning (Next Week Outlook)

- Bullish Case (~20% chance): Nifty holds 24,500-24,600 support and bounces. Upside catalysts could be a positive trade news or a better-than-expected U.S. GDP data. In this case, Nifty might head back to 25,000–25,200 quickly, driven by short-covering and DII buying stabilizing bank and auto stocks. Global cues firming (easing U.S. policy fears) could extend gains. Stock picks: Reliance, HDFC Bank, and Infosys could lead a relief rally if financial conditions calm.

- Self-critique: This scenario fails if tariffs or visa issues continue to dominate, or if FIIs remain heavy sellers. With momentum so negative, any bounce is likely shallow unless fundamental news improves dramatically.

- Bearish Case (~50% chance): Downside resumes. A decisive break below 24,500 spurs panic selling. Nifty then tests 24,200–24,300 (April lows). Bank Nifty would likely break 54,000, targeting 53,000. Continued FII outflows or a surprise hawkish Fed (or rising crude inflation fear) could trigger this. Financials and cyclicals (Maruti, Bajaj Finance) would underperform, while utilities and telecom could hold up. Nifty’s next support beyond 24,300 is near 24,000.

- Self-critique: This assumes no intervention; but if DIIs step in hard or RBI commentaries reassure bond markets, the fall could stall. Also, deeply oversold conditions might provoke a technical bounce (mean reversion trades by algo desks).

- Neutral/Consolidation (~30% chance): Nifty chops in a range 24,500–25,000. The market pauses as traders digest earnings season (some results start mid-Oct) and await clarity on U.S. policies. Both bulls and bears take turns testing 24,500 or 25,000 without lasting breakout. Volatility remains high within the range. This could happen if global markets stabilise (e.g. if Fed signals no hikes ahead) while domestic cues stay mixed. Range trading in Bank Nifty (54,000–55,500) would accompany this.

- Self-critique: A neutral scenario fails if either bulls or bears get control. Given current strong trend and negative news flow, neutrality requires a lack of new catalysts – a big if. The risk is skewed to the downside so the consolidation bias may be short-lived.

Most Likely Bias: The evidence leans bearishly for next week. The refined conclusion: expect lower highs and lower lows unless we see a shock reversal. Traders should prepare for further weakness, with risk at key supports.

Stong Levels & Stocks to Watch

- Nifty Index: Support at 24,500 (major April low zone) and then 24,300. Resistance at 24,800–25,000 (recent gap zone) and 25,200. Watch any closes above 25,000 for strength, or below 24,500 for acceleration.

- Bank Nifty Index: Support at 54,000–54,200; a break could drag it toward 53,500. Resistance at 55,000–55,200, then 55,600. A weekly close below 54,400 (10‑day EMA) suggests continuation of the downmove.

Heavyweight Stocks: Major catalysts: – HDFC Bank/ICICI Bank: Combined >20% of BankNifty. Watch ₹2300/₹850 support (respectively) and ₹2400/₹900 resistance. A slip under these could drag the indices.

– Reliance Industries: Nifty’s largest weight (~9%). Key pivot ~₹2400 (support) and ₹2500 (short-term resistance).

– TCS / Infosys: Tech leaders. Resistances ~₹4000/₹1700; supports ~₹3800/₹1600. If they bounce, Nifty gains; if they fall, Nifty suffers.

– SBI / Kotak Bank: Monitor ₹540/₹2700 respectively as support levels.

– Others: Auto leaders (Tata Motors ~₹850 S / ₹900 R), Metal giants (Tata Steel ₹105 S / ₹115 R), and FMCG (HUL ₹2400 S / ₹2550 R). Breakouts or breakdowns in these names will heavily influence index moves.

News and Events to Watch (Next Week)

- Global Events: U.S. Fed officials’ speeches (markets want guidance on rate cuts). Any U.S. jobs/inflation data (Sep) will be parsed. Treasury yields and dollar moves will matter. Watch crude inventory reports (API/EIA) for oil prices. In geopolitics, developments in U.S.-China/EU trade policy could shift risk sentiment.

- Domestic: RBI policy meeting on Oct 1 – but it’s widely expected to hold rates; look for any hints on future action. Fiscal policy news (Mid-Sep quarter GST collections). Any local inflation reports (WPI on Oct 14) or rural consumption data. Q2 earnings season unofficially starts late Oct – early commentary from banks or corporates (like interim results or management comments) will start trickling in.

- Corporate: Watch any big bank commentary (e.g. Q2 guidance or asset quality trends). Also sectors like tech (outsourcing majors) or pharma (Sun Pharma board meeting announcements). A few large-cap companies (e.g. TCS, Infosys) might give guidance or commentary in corporate calls.

- Other: Any RBI note on FX swaps or OMO (bond buying/selling) could impact interest rates. Keep an eye on the U.S. Fed meeting minutes due next Wednesday; any surprise stance could swing global flows.

Pre-Week Action Plan & Reassurance

- Checklist: Identify entry/exit triggers around 24,500 on Nifty and 54,000 on Bank Nifty. Set stops for any speculative longs (to manage risk in this volatile market). Update your watchlist of stocks breaking key levels (as noted above). Review margin requirements and hedge if needed (e.g. protective puts). Keep fresh charts of Nifty, BankNifty, VIX, and USD/INR.

- Intraday Triggers: Use support-resistance zones: a break below Nifty 24,500 with volume would invite short trades, while a rally above 24,800-25,000 could be a sell-in-rally signal. On BankNifty, watch 54,000/55,500 similarly. Sector and stock triggers: e.g. bank index breakouts or IT earnings chatter. Volatility expansions can mean quick fade of gaps – watch opening gaps for fills.

- Mindset: Be patient – trade setups will present themselves. Focus on price action and discipline, not chasing every headline. The market may whip back and forth; prefer confirmation on any move.

Remember: The market will always create opportunities — focus on levels and discipline, not overnight suspense.

[1] [8] Stock Market Highlights: Sensex settles 466 pts lower; Nifty below 25,250; TCS, Infy drop 3% each – The Economic Times

[2] [13] [16] Stock Market Highlights: Sensex settles 57 pts lower; Nifty below 25,200; Axis Bank rises 2%, TechM down 2% – The Economic Times

[3] [4] [7] [10] [15] Closing Bell: Nifty around 25,050, Sensex sheds 386 pts; FMCG outperforms | Moneycontrol News

[5] [9] Stock Market Highlights: Sensex extends slide to 5th day, ends 556 pts lower; Nifty below 24,900; Trent drops 4%, Power Grid 3% – The Economic Times

[6] [17] [19] Stock Market Highlights: Sensex falls for 6th day, settles 733 pts lower; Nifty below 24,700; M&M drops 4%, Eternal 3% – The Economic Times

[11] [12] Indian Markets Brace for Volatility: Nifty and Bank Nifty Face Bearish Headwinds Amid Global Tensions | FinancialContent

[14] RBI likely to hold rates at 5.50% on October 1 and through 2025

[18] POST-MARKET SUMMARY 25th September 2025

[20] FII & DII Trading Activity in Cash, Futures and Options, MF SEBI & FII SEBI Daily Trends Stocks Data